As a business owner in Edmonton, managing your finances and ensuring the success of your company is of utmost importance. In today’s competitive business landscape, the role of your Edmonton accountant in helping drive the success of established small and mid-sized businesses cannot be overstated. Beyond maintaining accurate financial records, accountants provide valuable services that contribute to the growth and prosperity of your business. They handle bookkeeping, compute taxes, and identify opportunities for tax reduction. However, if basic responsibilities are neglected, it may be necessary to consider hiring a new Edmonton accountant for your company.

Why Consider Hiring a New Edmonton Accounting Firm?

Outsourcing your accounting needs to a reputable Edmonton accounting firm offers numerous benefits. However, an incompetent accountant can wreak havoc on your books and create a host of issues for your company. But how do you determine when it’s time to make a change? Here are some key indicators:

Inadequate Communication and Responsiveness

Effective communication is vital in any business relationship, especially when it comes to managing your finances. If you find that your current Edmonton accountant is unresponsive to your inquiries, takes a long time to return your calls or emails, or fails to keep you informed about the financial status of your business, it may be a sign that it’s time to look for a new Edmonton accountant.

A competent accountant understands the importance of timely communication and ensures that you are always up-to-date with your financial information. They are proactive in addressing your concerns, promptly responding to your queries, and providing the guidance you need to make informed financial decisions.

Late Filing of Tax Returns

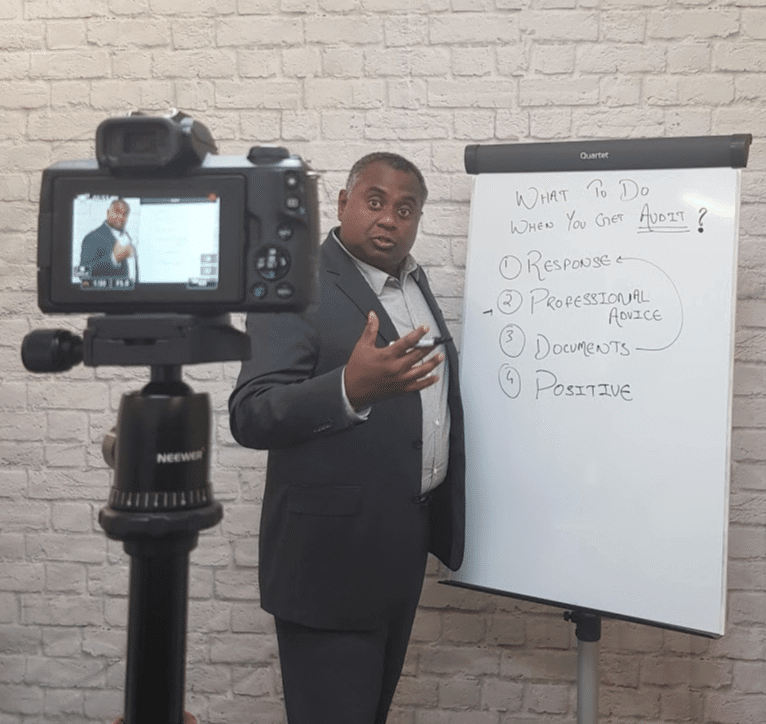

Failing to submit tax returns on time is a significant red flag. Not only can this result in penalties that burden the company financially, but it may also indicate a more serious underlying problem. An experienced and competent accountant understands the importance and value of their work. When they consistently submit late filings, they are failing to fulfil their duties. If discussing the issue with your accountant proves futile, it’s imperative to hire a new Edmonton accountant who can approach the situation with the utmost professionalism.

Lacks Expertise and Knowledge

Accounting is a specialized field that requires in-depth knowledge of terminology, processes, and laws. It’s crucial to work with an accountant who can confidently and clearly explain concepts such as tax-free benefits and deductions.

If your current accountant lacks the necessary expertise and specialization in your industry, they may struggle to understand the intricacies of your business and provide tailored financial advice.

A new Edmonton accountant with specific knowledge and experience in your industry can offer valuable insights, identify tax-saving opportunities, and help you optimize your financial strategies. Whether you operate in the healthcare sector, retail industry, or any other niche, finding an accountant who understands the intricacies of your business can make a significant difference in achieving your financial goals. An insufficient understanding of these fundamental accounting principles should serve as a clear signal that it’s time to find a new accountant without delay.

Insufficient Clarity in Financial Statements

For small businesses and startup owners, a thorough comprehension of financial statements is essential. If your current accountant lacks the ability to help you understand these statements, it can hinder your company’s financial growth. What’s more, if your current accounting firm does not provide accurate financial reporting to help you make informed business decisions and ensure compliance with legal requirements or if you notice frequent errors, inconsistencies, or discrepancies in your financial reports prepared by your current accountant, it raises concerns about their attention to detail and the overall quality of their work.

A new Edmonton accountant who is meticulous and detail-oriented can ensure that your financial reports are accurate, reliable, and reflect the true financial health of your business. By providing you with error-free reports, they empower you to analyze your financial data effectively and make informed decisions that drive your business forward.

Limited Proactive Financial Advice

Beyond crunching numbers and preparing tax returns, a competent Edmonton accountant should serve as a trusted financial advisor for your business. If your current accountant simply meets basic compliance requirements without offering proactive financial guidance, it may be time for an upgrade.

A new accountant who understands your business goals, identifies areas for improvement, and provides proactive financial advice can help you optimize your financial processes, minimize tax liabilities, and maximize profitability. Their insights and recommendations can be invaluable in guiding your long-term financial strategy and ensuring sustainable growth.

Unable to Keep Up with the Growth and Complexity of Your Business

As your business expands and becomes more complex, your accounting needs evolve accordingly. If your current accountant is unable to keep up with the increasing demands of your growing business, it’s a clear signal that you need to hire a new Edmonton accountant.

A capable accountant who specializes in handling the complexities of expanding businesses can provide the necessary expertise to navigate challenges such as multi-state taxes, international transactions, and complex financial regulations. By partnering with such an accountant, you can have peace of mind knowing that your financial matters are in capable hands, allowing you to focus on driving your business forward.

Lack of Integrity and Transparency

Not all accountants are equal. If your accountant is concealing information, struggling to explain financial records, or appears to manipulate business accounts, it’s time to seriously consider finding a replacement. When seeking a new Edmonton accountant, prioritize reputable Edmonton accounting firms to ensure the quality of work you will receive.

Contact ATS Accounting and Tax Edmonton Today!

Choosing the right accountant is pivotal to the success of your business. Your Edmonton accountants are responsible for more than just financial transactions—they provide invaluable services that contribute to your company’s growth. By being vigilant and recognizing the signs indicating the need for a new accountant, you can safeguard your business’s financial health and ensure a prosperous future. Remember to select an accountant from a reputable accounting firm in Edmonton to guarantee the highest standards of work.

ATS Accounting and Tax Edmonton has an experienced team of financial advisors who will help you manage your business’s paperwork. Our team of dedicated accountants and bookkeepers knows the specific risks you may face and help ensure your business is protected.

Ready to get started? For more information about our accounting and tax services, book your free 15-minute consultation by calling us at 587-406-3038 or contacting us online.